The charge of fraud by false representation relates to a trust set up in Singapore that contained $650m, the equivalent of £400m in 2015. That year, Ecclestone met with HMRC in an attempt to end investigations into his tax affairs. He told officers that he set up a single trust in favour of his daughters and said that he had no links to further trusts “in or outside the UK”.

“That answer was untrue or misleading,” said Richard Wright KC, prosecuting. “Mr Ecclestone knew his answer may have been untrue or misleading. As of 7 July 2015, Mr Ecclestone did not know the truth of the position, so was not able to give an answer to the question.

“Mr Ecclestone was not entirely clear on how ownership of the accounts in question were structured. He therefore did not know whether it was liable for tax, interest or penalties in relation to amounts passing through the accounts.

“Mr Ecclestone recognises it was wrong to answer the questions he did because it ran the risk that HMRC would not continue to investigate his affairs. He now accepts that some tax is due in relation to these matters.”

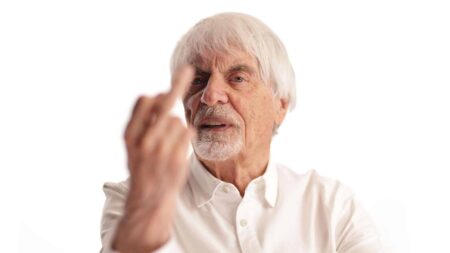

Ecclestone attended this year’s opening Grand prix in Bahrain; the court heard that he is now in frail health

Gongora/NurPhoto via Getty Images

Defending, Clare Montgomery KC said that Ecclestone “bitterly regrets the events that led to this criminal trial” and that the answer he gave was a “lapse of judgement”.

“It was not Mr Ecclestone’s intention to avoid paying tax,” she said. “He has always been willing to pay the tax that was due.”

Ecclestone is now in “frail health”, the court heard.

It is the second time that he has walked from court following a settlement: allegations that Ecclestone had bribed a German banker were dropped by a Munich court in 2014, following a $99m payment to the German treasury and a $1m charity donation, which totalled the equivalent of £60m.