So what does this mean for the future? In the short term not much. Bugatti will still build cars in Molsheim and I expect its monster ICE engine will survive for as long as legislation allows, because when your customers are in that league, they don’t like being told what they can and cannot drive. But actually electricity makes a great deal of sense as a power source for a modern Bugatti: its cars are already huge, heavy and rely on blistering acceleration for a USP, all of which an electric Bugatti is bound to provide.

But it may not all be plain sailing. The evidence is anecdotal because no-one publishes the figures, but my very strong sense is that electric hypercars are not exactly finding favour out there at the moment. Indeed, were Lotus, Rimac and Pininfarina – the three main players in this market – selling out their already very limited runs of cars, you can bet your bedroom they’d not be shy about saying so. On the contrary, my understanding is that this niche within a niche corner of the market is proving exceptionally difficult for them.

And perhaps that’s not such a great surprise: while people will pay many tens of thousands to add some wildly desirable mechanical watch to their collection, so far as I am aware no one has ever paid big money for a purely motorised watch. There is an emotional dimension, that connection to the engineers who sweated blood perfecting all the cogs, levers and springs that make a perfect chronometric movement, that is simply missing.

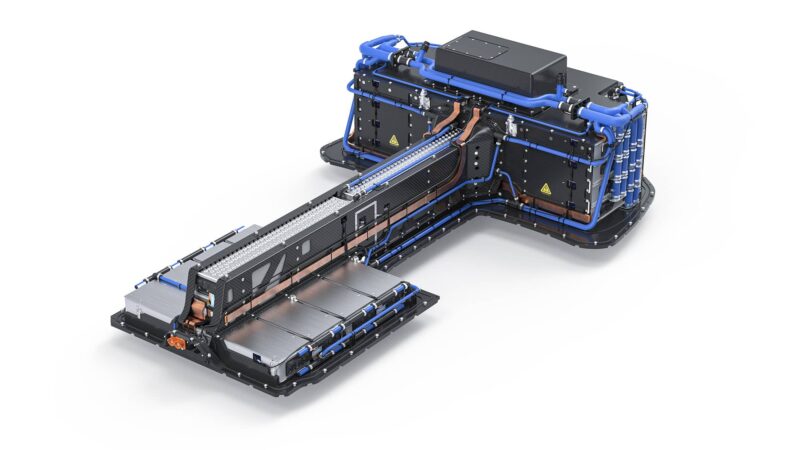

Rimac’s battery (and motor technology) is highly prized in the automotive world

That might change in time when there are no more mechanical cars to buy, and the truth is all car companies right now have very little choice but to embrace the EV. But they must do so more in hope than expectation that as they wrap their arms around each other, it doesn’t take the opportunity to sink its teeth into their necks.

The Bugatti-Rimac joint venture has also reignited speculation that VW is open to selling off the family jewellery in its massive push toward its own all-electric future. Investors have certainly not been shy questioning the sense of keeping not very EV-friendly brands like Lamborghini and Ducati under the corporate umbrella. As the FT reported yesterday: ‘…pressure from capital markets to divest these brands had been mounting. “The message is ‘forget the toys’” said someone familiar with the discussions between VW and investors.’ We will watch further developments with interest.