GP collection's future in doubt

The collapse of Donington Ventures Leisure Ltd has left a question mark over the future of the Donington Park Grand Prix Collection, the unrivalled gathering of racing cars assembled by…

With live sales still to get back on track, the true state of the market is still hard to judge. Values are certainly depleted in many areas, and the enthusiasm for bidding online that was apparent at the start of lockdown appears to have diminished somewhat – but, as ever, the right lots at the right reserves continue to sell easily.

On a separate note, we received worrying news from a successful bidder at the last sale held by Coys (in February) before the firm went into administration in April.

Having bought and paid for his car fair and square he proceeded to drive it happily for four months – until he was stopped by the police and told that the vendor had reported it stolen because Coys had failed to pay him.

The consensus is that the buyer has true title to the car, having paid for it in full and honoured his contractual obligations, meaning the vendor must seek redress through the administrators. Nevertheless, until the vendor agrees

to have it removed from the stolen vehicle database, the new owner can no longer insure it – and, therefore, can’t drive it.

Caveat emptor, indeed…

McLaren MP4-24 show car.

Sold for £66,000, R.M.Sotheby’s

The show car used to promote McLaren’s 2009 F1 charger proved the top seller in this 95-lot #RaceAgainstCovid-19 sale organised by R.M. Sotheby’s in conjunction with the FIA. The motor sport community pulled together to donate items, ranging from F1 drivers’ race suits to artworks and experiences. The £845,472 raised will go to help the Red Cross and Red Crescent’s response to the pandemic – bringing the FIA’s total donations to nearly £2m.

2018 Westfield Eleven. Sold for £23,650. CCA.

This superbly detailed Westfield could easily have been mistaken for a ‘new, old stock’ example of one of Frank Costin’s Lotus originals from 1956. Built by a meticulous race engineer using £35,000 worth of new or reconditioned parts, it had covered a mere 300 miles.

2007 MG XPower SVR. Sold for £33,750 H&H

The XPower SVR was undoubtedly one of the then-ailing marque’s finest achievements – styled by Peter Stevens of McLaren F1 fame and powered by a Roush-tuned, 5-litre V8 and built on a race-bred chassis. A mere nine examples were sold. This one had done just 15,000 miles.

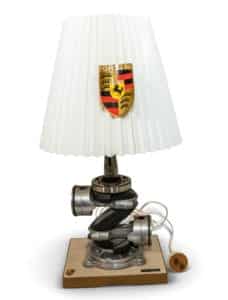

Part one of this two-part ‘Lifetime of Porsche’ online memorabilia sale was a reminder that anything connected to revered marques has a value. This table lamp was a promotional gift from the 1960s, it featured a miniature crankshaft and pistons. It probably ended-up in a man cave after being barred from the family sitting room…

1982 Honda CB1100RC. Sold for £9000 H&H

With just 1500 made in order to homologate the model for production racing, original, un-damaged and un-restored examples such as this are rare, and according to classic Japanese motorcycle expert Paul Jayson (aka The Motorcycle Broker) could well soar in value.

1969 AMF Probe. Sold for $2280. R.M. Sotheby’s

One of 53 museum-quality pedal vehicles sold by restorer Bruce Callis, the Probe featured tank-like lever steering. The sale grossed almost $150,000, with the star lot being a British J40 roadster similar to the Settrington Cup racers at the Goodwood Revival.

Can we be upfront and state for the record that buyer’s fees suck?

And while you might not think that this is a controversial statement, the reasons we feel this way might surprise you. Buyer’s fees have been around for thousands of years. First recorded during the reign of Augustus in Rome when a two per cent tax was levied on auction purchases, we think the first time they made an appearance here in the UK was in September 1975 when both Christie’s and Sotheby’s introduced a 10 per cent rate on top of their seller’s fees.

They were brought in as part of the competition all auction houses engage in for sellers; low seller’s fees make a house appear more attractive to a vendor (we’ll ignore the ‘you get what you pay for’ angle for now) so changing the name of some of those charges to buyer’s fees appears to shift the burden from the seller to the buyer. But appearances can be deceptive, because it’s my experience – both as a private buyer and in running The Market – that buyers have a budget and if they’re forced to stump up an extra, say, 10 per cent on the hammer price then they’ll simply deduct that amount from their maximum bid.

This is hardly rocket science, but it’s amazing how few sellers appreciate that a lower seller’s premium doesn’t necessarily equate to more money in their bank account when the dust settles. Calling them a ‘buyer’s premium’ sounds almost benign; referring to them as ‘additional sellers’ fees’ would be accurate, but a PR disaster. Some sellers were never fooled but were reassured that at least their fees were open to negotiation. Not so for the poor old buyer, which means that while the auction house gives with one hand it takes with the other because every fee charged, no matter which side it comes from, is ultimately taken from the seller’s proceeds.

Established auction houses love it; who wouldn’t like two bites at a juicy cherry? And yet, this greed – a position that works as long as everyone plays along and no-one rocks the boat – only leads to customer dissatisfaction in the long term. And a partial collapse of the system when someone like us comes along and refuses to charge it at all. Why did we choose to charge only a five per cent seller’s fee and no buyer’s premium?

It’s simple; we primarily provide a service to the seller. Yes, the buyer gets to buy but we’re here – as is every other auction house – to enable sellers to sell, so why would we want to charge buyers, too? Of course, the system is sometimes a little more forgiving than that. In the good old days, when the classic car market was booming and a hefty profit was almost guaranteed, many didn’t care; if you were selling a car for way more than you had bought it for then you didn’t mind if that profit was partially diverted to the auctioneer via a buyer’s premium – and if you were buying in the knowledge that you would turn it for a fat profit in a few months, then you didn’t care about having to stump up a bit extra.

But now we have an enthusiasts’ market again, prices aren’t soaring and having to pay a buyer’s premium hurts – so you either refuse to play or you adjust your bid accordingly. Everyone loses in the former case, while only the auction house wins in the latter – and no-one is fooled anymore by whatever euphemism is deployed to try to justify the high charges. And that is why we don’t like them, and why we have refused to charge them.